what is the salt deduction repeal

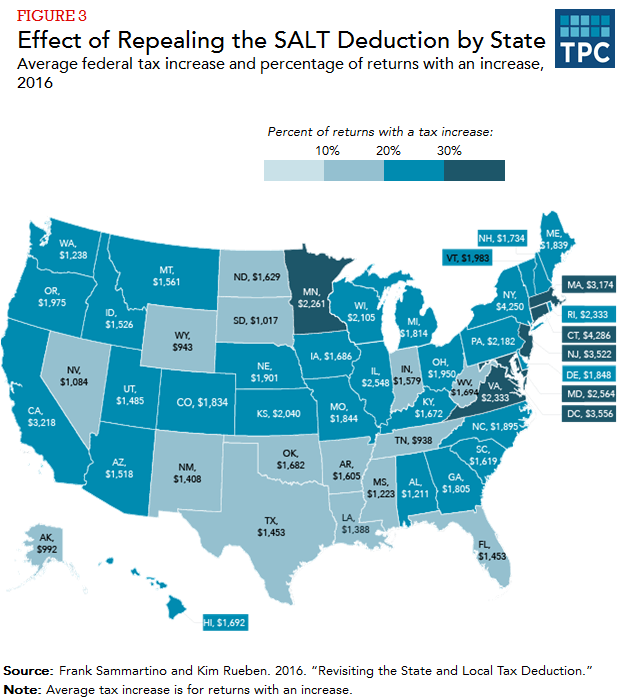

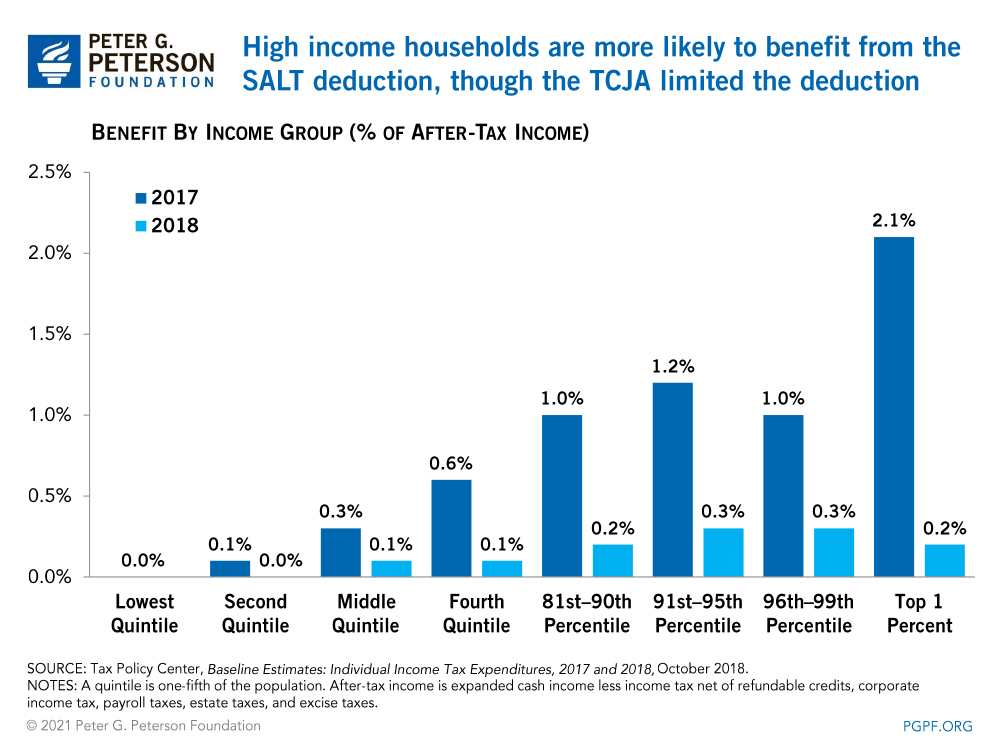

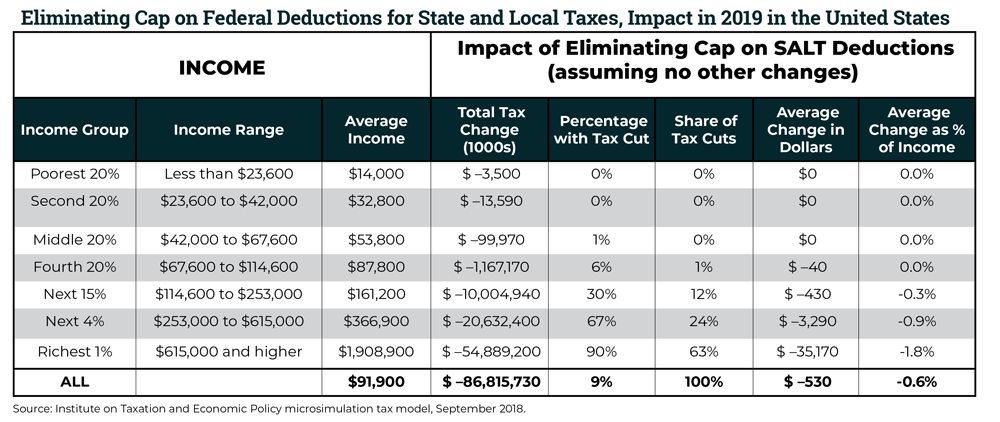

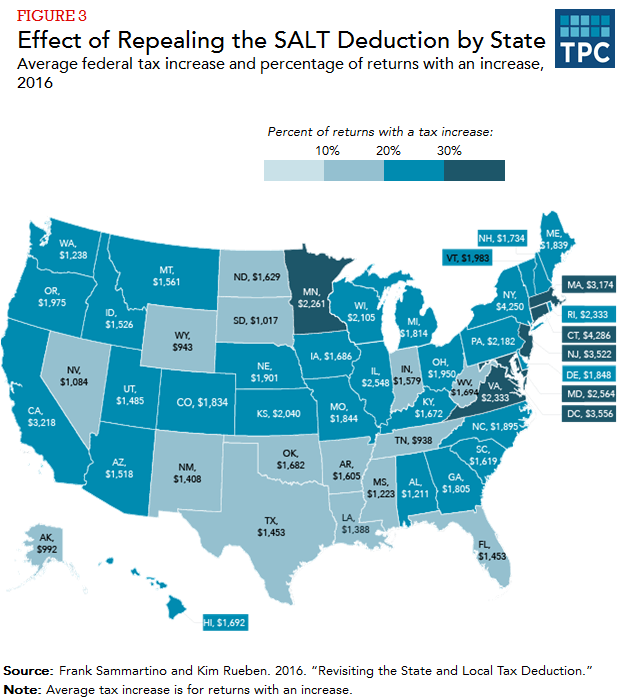

Preserving the deduction cap or better yet a full repeal of the SALT deduction would result in wealthy residents feeling the full effect of the policies passed by their state and local governments. House Democrats spending package raises the SALT deduction limit to 80000 through 2030.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

New limits for SALT tax write off.

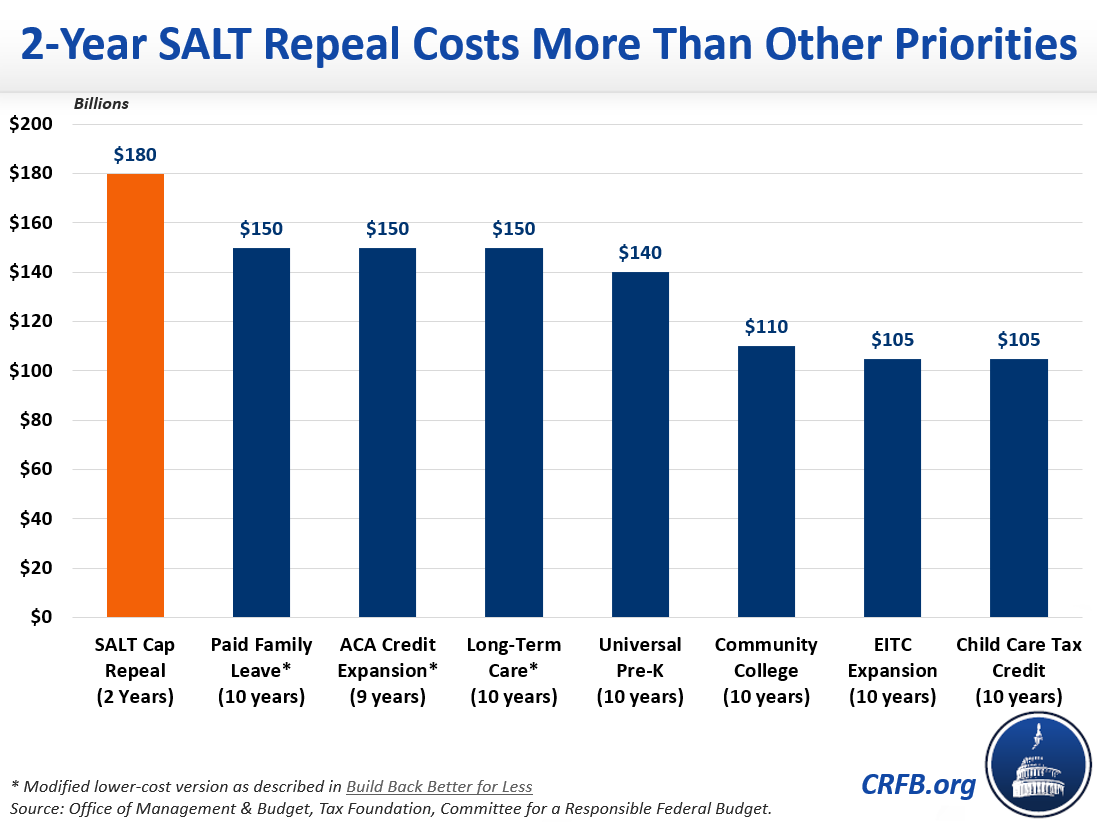

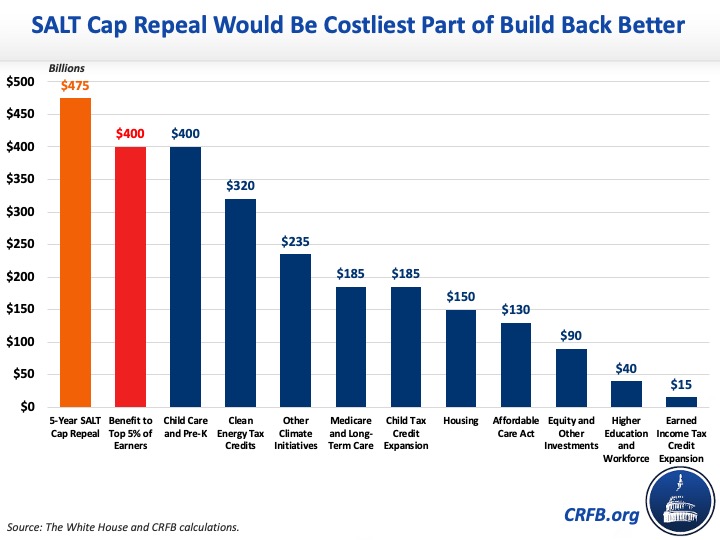

. The bill passed on Thursday includes some budgetary gymnastics in order to avoid. The acronym salt stands for state and local tax and generally is associated with the federal income tax deduction for state and local taxes available to taxpayers who itemize their deductions. Though this increase in the SALT deduction cap would be less costly than full repeal it would still cost more than almost any other part of Build Back Better with just the child care subsidies.

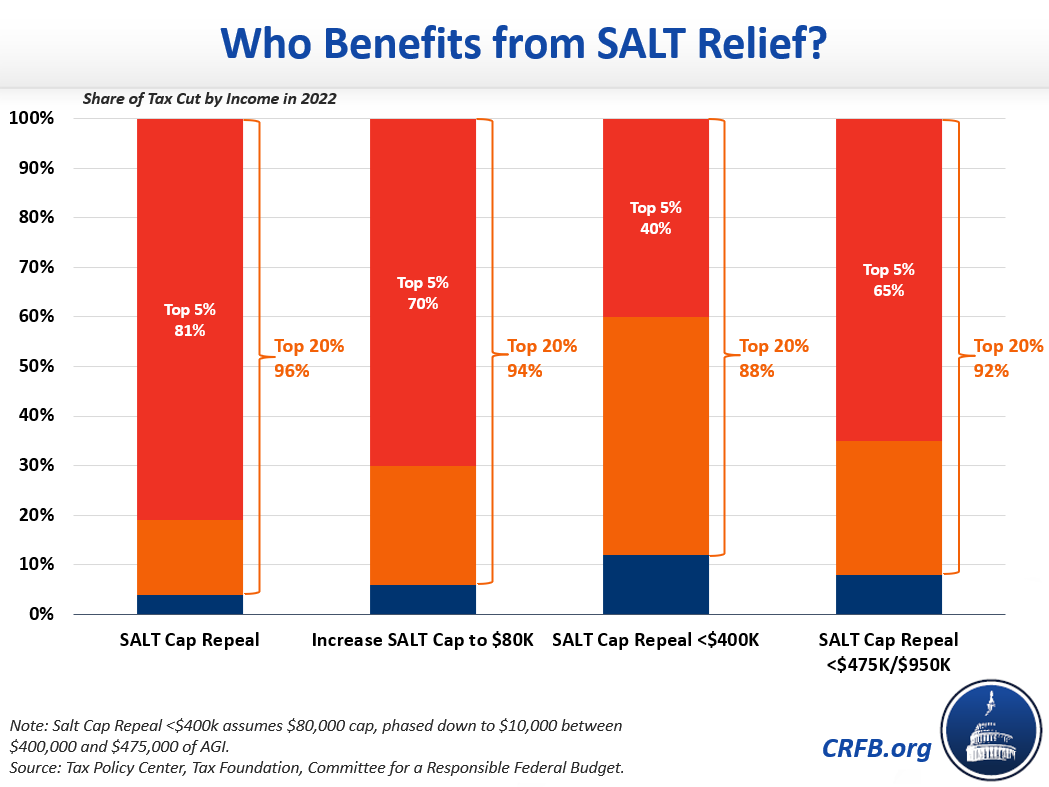

54 rows Some lawmakers have expressed interest in repealing the SALT cap which was originally imposed as. A bill from House Ways and Means Chairman Richard Neal and others would modify and then repeal for two years the 2017 tax laws cap on the federal deduction for state and local taxes SALT and offset the cost over ten years. Taxes According to press reports the Senate is considering repealing the 10000 cap on the state and local tax SALT deduction for those making 500000 per year or less.

This significantly increases the boundary that put a cap on the SALT deduction at 10000 with the Tax Cuts and Jobs Act of 2017. Lawmakers in high tax states particularly Democrats are pushing for a repeal of the 10000 cap on the SALT deduction. House Democrats in November passed a spending package boosting the SALT cap to 80000 from 2021 through 2030 before reinstating the 10000 limit in 2031.

What is the salt deduction repeal. This new provision is effective for Tax Years 2018. Starting in 2021 through 2030 the SALT deduction limit is increased to 80000.

Monday May 23 2022. A growing rift among Democrats over whether to repeal a Trump-era limit on state and local tax deductions is threatening to derail President Biden s. The change may be significant for filers who itemize deductions in high-tax states and.

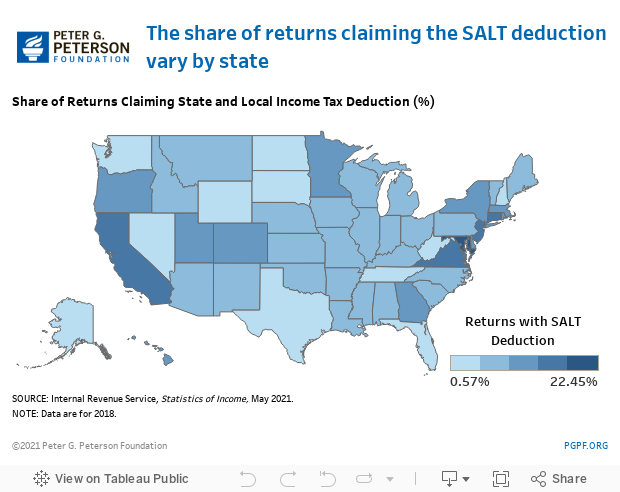

52 rows The state and local tax deduction commonly called the SALT deduction is a federal. 11 rows As President Bidens tax plans are considered in Congress the future of the 10000 cap for state. A woman runs some number while completing her tax return.

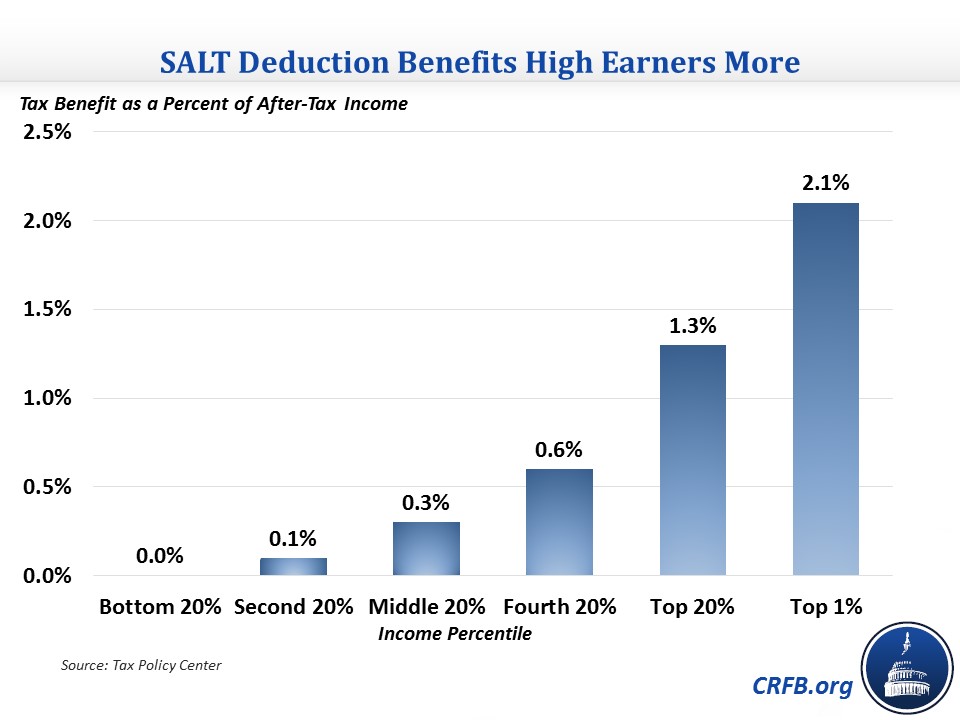

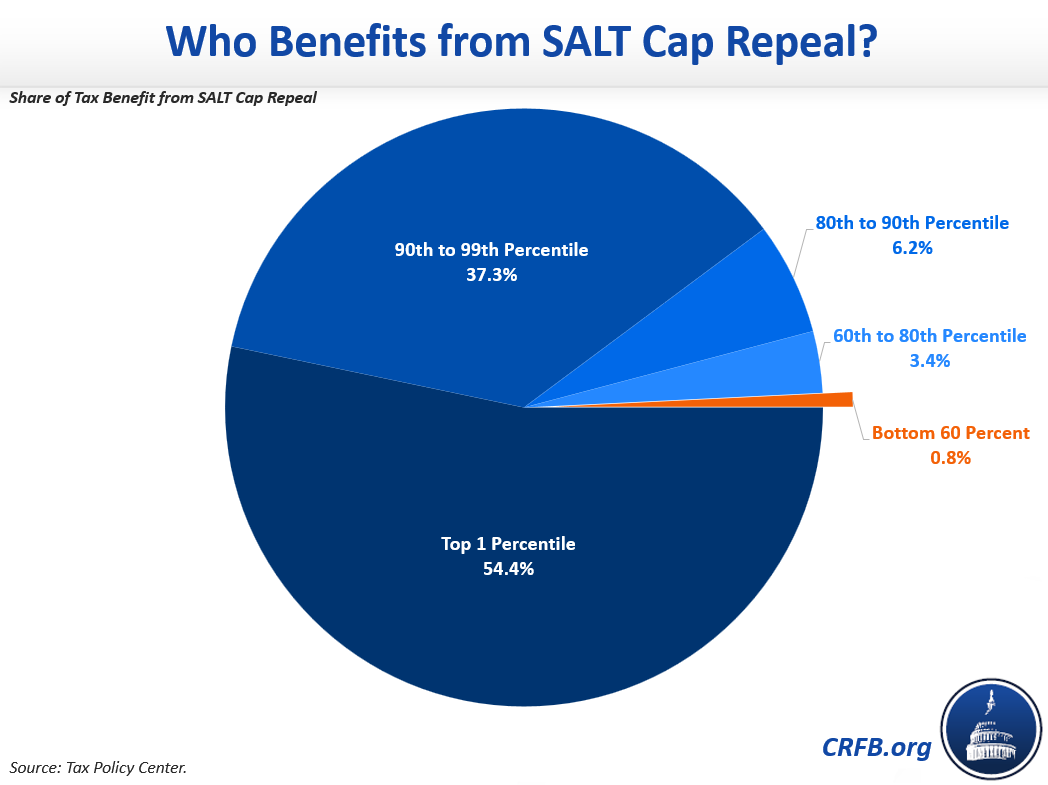

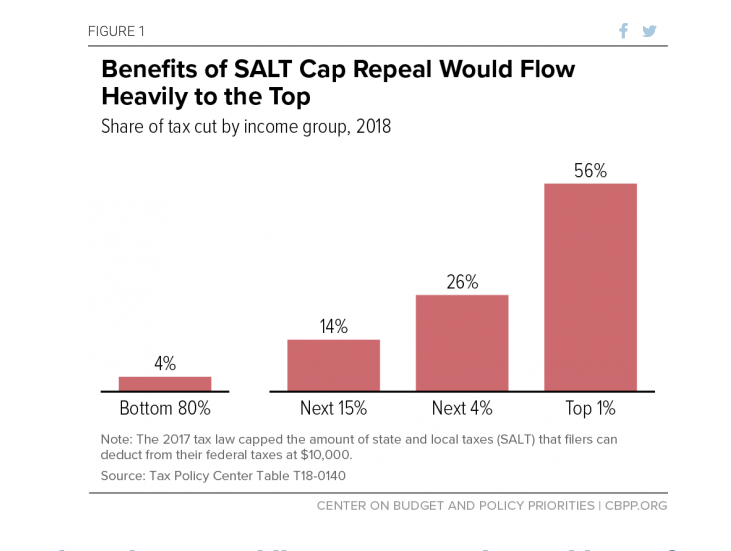

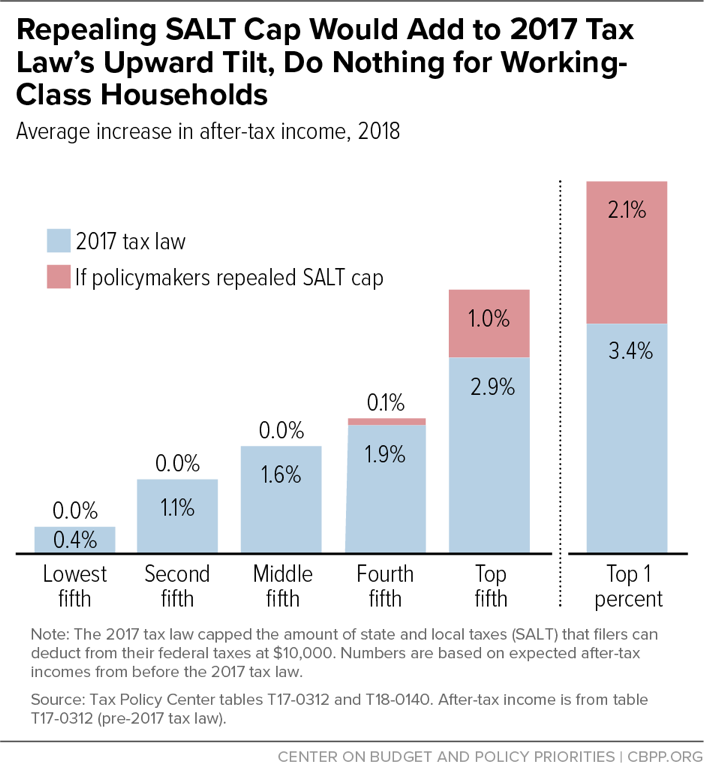

The SALT deduction allows states and localities to give their high income earners a discount on their taxes. SALT Cap Repeal Below 500k Still Costly and Regressive Nov 19 2021 Taxes According to press reports the Senate is considering repealing the 10000 cap on the state and local tax SALT deduction for those making 500000 per year or less. The SALT cap was tucked into the 2017 tax overhaul in part to help finance it and reduce its impact on the deficit.

The state and local tax deduction. The SALT cap blocks taxpayers from deducting more than 10000 per year in their state and local taxes when itemizing federal deductions. Before 2018 the SALT deduction was not limited meaning individuals could deduct 100 of the state and local taxes paid each year as an itemized deduction.

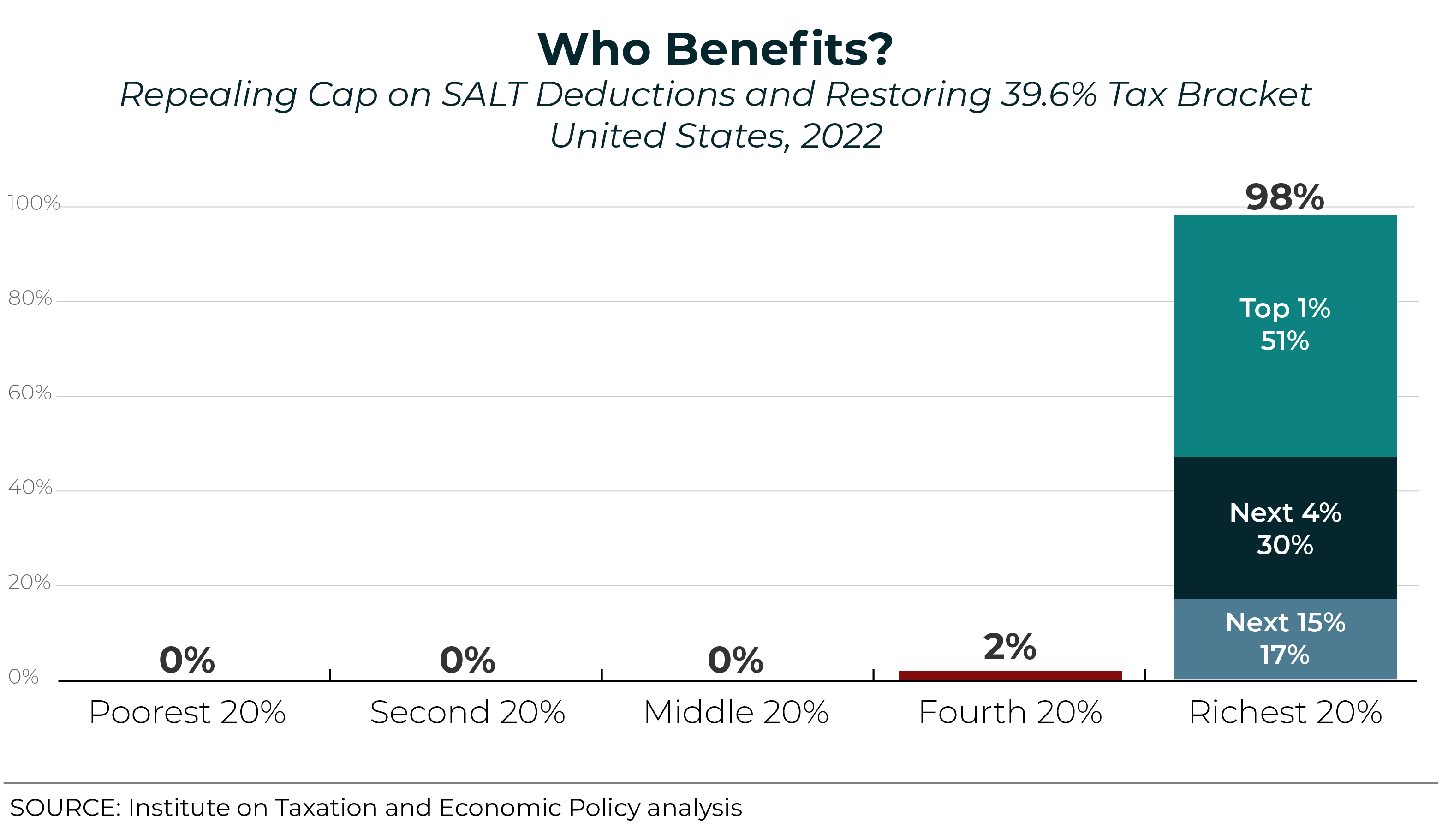

What is the SALT Deduction. This includes calls to eliminate the tax deduction cap on state and local tax payments often referred to as the SALT Deduction The SALT Deduction allows taxpayers who choose to itemize their deductions usually the richest Americans to include state and local taxes to offset their federal tax liability. As part of the 2017 Tax Cuts and Jobs Act the amount of state and local taxes that could be deducted as an itemized deduction was limited to 10000.

A new bill seeks to repeal the 10000 cap on state and local tax. This would be in place of the House plan to lift the cap to 80000 through 2030 and reinstate it at 10000 for 2031. A new bill seeks to repeal the 10000 cap on state and local tax deductions.

But such a repeal would mostly benefit high-income taxpayers and force the. However the bill stalled in December. A group of moderate lawmakers are pushing to repeal the so-called SALT deduction cap in the reconciliation package saying no SALT no deal but other Democrats are trying to slam the brakes on.

Though there is a controversy behind this change as the average SALT tax paid isnt even one-tenth.

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

Salt Deduction Resources Committee For A Responsible Federal Budget

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Eliminating The Salt Cap To Help The Rich Doesn T Fight Coronavirus Ways And Means Republicans

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

Salt Deduction Cap Should Be Reformed Not Repealed Itep

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

House Democrats Latest Bill On Salt Deductions Would Mean Bigger Tax Cuts For The Rich Itep

State And Local Tax Salt Deduction Salt Deduction Taxedu

Salt Repeal Just Below 1 Million Is Still Costly And Regressive Committee For A Responsible Federal Budget

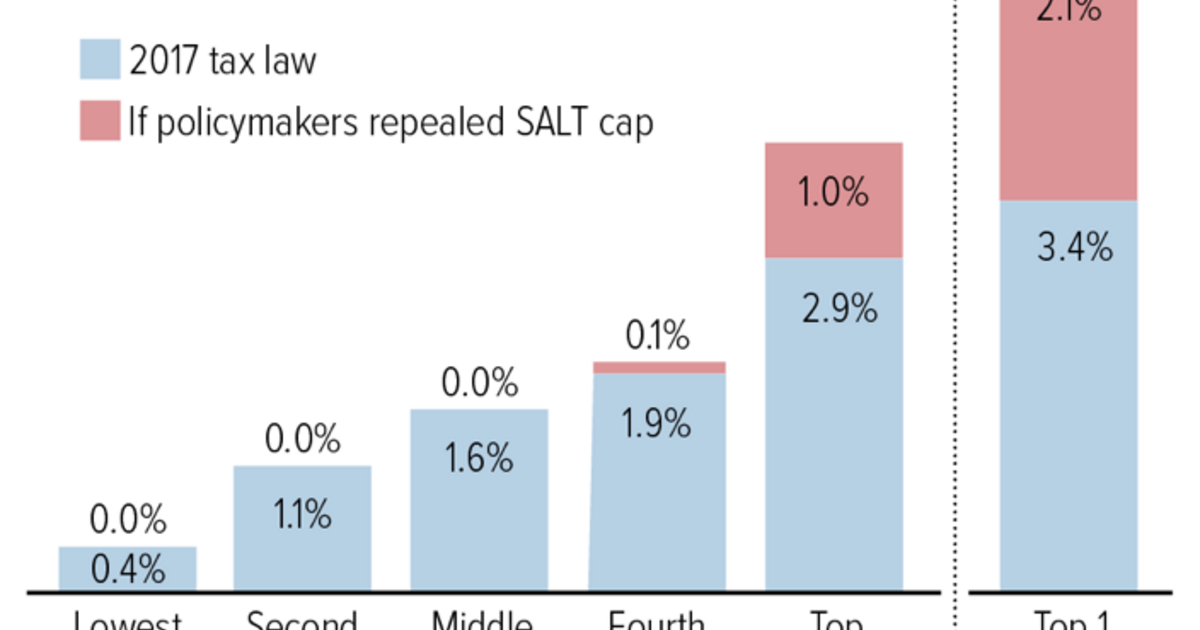

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities